Contents

However, there are times when neither the purchasing nor the selling tendencies are powerful enough to drive the market in a specific direction. As a result, the market moves aimlessly under the influence of uncertainty. A spinning top candlestick can assist you comprehend the situation in such instances. A spinning candlestick pattern is most likely to feature a real short body which is vertically placed between long upper and lower shadows. At the peak of an upward trend, a single candlestick pattern known as the Hanging Man formation heralds a probable change in trend direction. Although the Hammer and Shooting Star are comparable to this candlestick, there are several significant variances in price direction and shape.

A spinning top candle can also mark the beginning of a trend reversal; but most significantly, it is an identifier of a situation when neither buyers nor sellers enjoy an advantage. If you are trying to find a spinning top candle in the chart, look for a figure that is symmetrical with equal lengths of upper and lower shadows. The main body is relatively small in size depicting only a marginal difference between the opening and closing prices. Its unique appearance is due to market pull caused by both buyers and sellers. Buyers try to push the price up, whereas sellers try to lower it, but both fail to sustain the change.

At these specific times, the Spinning Top candlestick pattern is the most effective. A tweezer bottom is a bullish candlestick pattern that is formed at the end of a downtrend in the market. It is formed when the sellers are not able to push the prices down any further in the market. This candlestick pattern represents extreme bearishness in the market.

How To Make Money From Stock Market

You can literally create millions of possible returns through the use of options. You can mix and match options to create just about any return possible. You should go through a systematic process before initiating a trade. It can be very dangerous to your bank account to disregard some or all of the major factors that affect options prices. The three inside down is a candlestick formation that is formed at the top of an uptrend.

Take your time to analyze the pattern and invest only a fractional amount to get a better idea of the motion set forth by the spinning top. It would be better if you do not rely solely on the spinning tops for your trading decisions. The majority of the traders tend to use technical indicators to ensure what they believe a spinning top indicates.

Any Grievances related the aforesaid brokerage scheme will not be entertained on exchange platform. Pay 20% or “var + elm” whichever is higher as upfront margin of the transaction value to trade in cash market segment. Stock Brokers can accept securities as margin from clients only by way of pledge in the depository system w.e.f. September 1, 2020. Only 1st-time attempt at the quiz will be considered to qualify on the leaderboard.

So, just turn on the music and try to strike a positive balance in your trade. Do you have the nerves of steel or do you get insomniac over your investments? This story first appeared on MintGenie and can be accessed here.

Continue Reading

They can also move their stop-loss target towards the breakeven point. The first candlestick occurs due to the ongoing rising trend in markets. This bullish candle may or may not have wicks in its structure. However, as the day went on, bearish sentiments started taking over stock. Eventually, it closed at Rs.245, which was even lower than the opening price of the previous day.

The real body would have turned into a lengthy red candle if the bears had been successful. Thus, this might be seen as a bearish attempt to drive down stock prices, but they were unsuccessful. Trading using candlestick charts has grown in popularity on the bitcoin market.

When a company’s stock prices skyrocket and become too high for a significant portion of investor… This article has been prepared on the basis of internal data, publicly available information and other sources believed to be reliable. The information contained in this article is for general purposes only and not a complete disclosure of every material fact. It should not be construed as investment advice to any party.

The Spinning Top Candlestick

A spinning top pattern consists of a single candle that represents market uncertainty. The candlestick itself has a small body surrounded by long wicks on either side. At the candle’s closure, the https://1investing.in/ spinning top can either be bullish or bearish. This candlestick pattern frequently appears in uptrends, downtrends, and sideways movements, all of which indicate potential trend reversals.

An easy way to learn everything about stocks, investments, and trading. The small size of the real body indicates that the open price and the close price for the specified time frame are close to each other. It can be represented with blue/green/white color indicating bullishness or red/black color indicating bearishness for the specified time frame. The Hanging Man candlestick pattern on a price chart serves as a cautionary signal for buyers who want to hold the price for greater profit. For buyers, managing the trade by exiting the market at a profit, ensuring some gain, is helpful. On the other hand, it suggests a potential entry point for sellers, subject to additional confirmations.

Imagining the spinning top in its entirety, including the true body, upper shadow, and bottom shadow. The bears’ attempts to drive the markets lower were unsuccessful. The little actual body is evidence that neither the bulls nor the bears were able to exert any influence on the market. The candle’s colour doesn’t really matter because the open and closing price points are close to one another.

It’s important to note that trades cannot be taken solely on the basis of ‘Spinning Tops’ getting formed on the chart. In fact, a spinning top only shows that both the bulls and bears are interested in setting the motion of the price and pattern in their favor. Moreover, the spinning top also suggests indecision and friction as neither Bulls nor Bears were able to influence The market. No, we are not going to discuss the toy that comes with a string and spins rapidly. Instead, we are going to discuss the spinning top candlestick, which is quite different from the ones you see in top stock photos. Spinning tops are most likely to indicate the indecision of the security as the upper and lower shadows.

- To understand it let’s consider each of the following components separately.

- Candlestick-based trading first gained popularity in the stock market, but it is now also useful in trading cryptocurrencies and foreign exchange.

- The Hanging Man candlestick pattern on a price chart serves as a cautionary signal for buyers who want to hold the price for greater profit.

The low point of the first candle is almost equal to the low point of the second candlestick, which is bullish. It indicates a bullish reversal; the bear phase ends with the start of this pattern. Stock markets or three black crows pattern the respective stock should be on a rising trend. Hence, you cannot execute trades simply based on the appearance of a ‘Spinning Top’. Some people might even call it a ‘Doji’ candle, but the shadows are large.

One of the essential parts of the Vast Japanese candlestick pattern repertoire with its own unique characteristics is the Spinning Top Candlestick Pattern. We do not sell or rent your contact information to third parties. These patterns are characterized by a long lower shadow with a small upper body.

Features of Spinning Top Candlestick Formation

Suddenly, there is selling pressure and the stock forms a ‘Spinning Top’. This, again, could be an indication that the stock might have created a short term top. The indecision was there, but for the first time in the last few days – a stock which was moving downwards, is looking interesting to the buyers. This movement could be an indication that the stock might rise up in the next few days. If the Spinning Top appears during a downtrend, it could suggest a potential reversal in trend. The opening was 200, the close was 202 – which means a small green candle.

Have you compared the personal interest rates and processing fees? A Demat account was created to eliminate the time-consuming and inconvenient procedure of purchasin… One way to know if the stock is under/overvalued is to examine a company’s Price-to-Book ratio…

But suppose the trader’s decision was wrong and the stock price starts falling instead of rising, even then the trader will lose only half because he has bought only half the shares. Because the open price and the close price are so close to each other, the color of the candle doesn’t mean much. It does not matter whether the candle is green or red, it means that the open price and the close price are very close to each other. In appearance, this candle is a very simple and small real body candle, but in reality, the signs of many events that happened during the day are hidden if we look at these events.

The result is a short-body candlestick with elongated shadows at either side. It may depict that the market players are losing confidence in the current trend, and a reversal is waiting just around the corner. In the above chart, we can see the spinning top candlestick pattern pops up at the top of the uptrend. This indicates the indecision between buyer & sellers which leads to reversal. In simple words, the Spinning top tells traders that there are chances of a possible reversal or continuation trend.

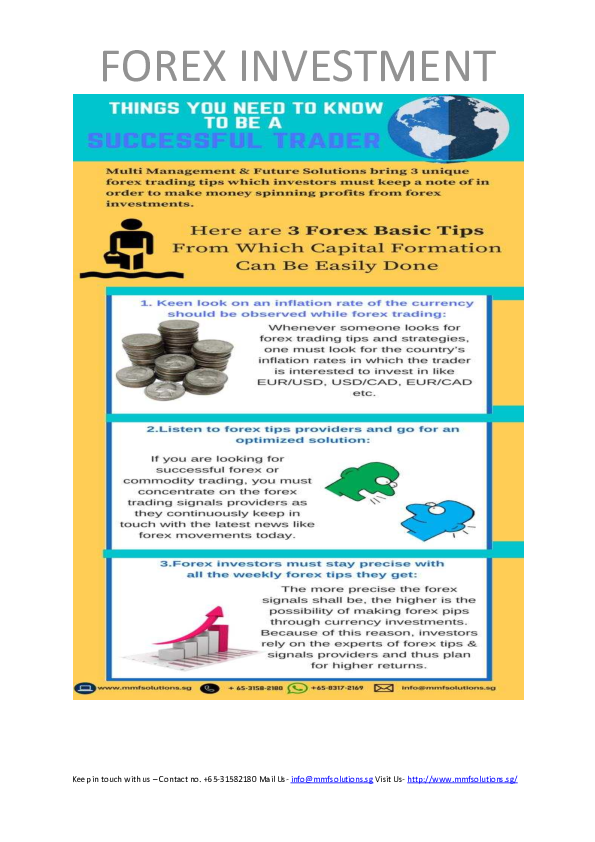

Additionally, its efficiency aids investors in discovering lucrative trades on any financial market. Candlestick-based trading first gained popularity in the stock market, but it is now also useful in trading cryptocurrencies and foreign exchange. As a result, current cryptocurrency brokers use candlestick charts to increase the profitability of investing in crypto assets.