Prepaid expenses or unearned revenues – Prepaid expenses are goods or services that have been paid for by a company but have not been consumed yet. This means the company pays for the insurance but doesn’t actually get the full benefit of the insurance contract until the end of the six-month period. This transaction is recorded as a prepayment until the expenses are incurred.

Click on the next link below to understand how an adjusted trial balance is prepared. Uncollected revenue is the revenue that is earned xero review but not collected during the period. Such revenue is recorded by making an adjusting entry at the end of accounting period.

Example of an Adjusting Journal Entry

Be aware that there are other expenses that may need to be accrued, such as any product or service received without an invoice being provided. Accruing revenue is vital for service businesses that typically bill clients after work has been performed and revenue earned. An accrued expense is an expense that has been incurred before it has been paid. For example, Tim owns a small supermarket, and pays his employers bi-weekly. In March, Tim’s pay dates for his employees were March 13 and March 27.

Then, in February, when the client pays, an adjusting entry needs to be made to record the receivable as cash. In the accounting cycle, adjusting entries are made prior to preparing a trial balance and generating financial statements. For example, going back to the example above, say your customer called after getting the bill and asked for a 5% discount.

In February, you record the money you’ll need to pay the contractor as an accrued expense, debiting your labor expenses account. Payroll is the most common expense that will need an adjusting entry at the end of the month, particularly if you pay your employees bi-weekly. Accrued revenue is revenue that has been recognized by the business, but the customer has not yet been billed. Accrued revenue is particularly common in service related businesses, since services can be performed up to several months prior to a customer being invoiced. In order to account for that expense in the month in which it was incurred, you will need to accrue it, and later reverse the journal entry when you receive the invoice from the technician. We post the purchase in this manner because you don’t fully deplete the usefulness of the truck when you purchase it.

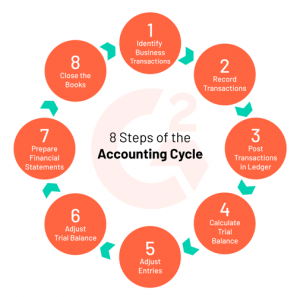

The preparation of adjusting entries is the fifth step of accounting cycle and starts after the preparation of unadjusted trial balance. When you pass journal entries, you will Debit the Expenses A/c and Credit the prepaid asset account. Adjusting entries ensure that the accrual principle is followed when recording incomes and spending. Closing entries are those that are used to close temporary ledger accounts and transfer their balances to permanent accounts. As learnt, that to arrive at a correct figure of profits and loss as well as true figures in the balance sheet, certain accounts require some adjustments.

Non-Cash Expenses

By doing so, the effect of an adjusting entry is eliminated when viewed over two accounting periods. As shown in the preceding list, adjusting entries are most commonly of three types. The first is the accrual entry, which is used to record a revenue or expense that has not yet been recorded through a standard accounting transaction. The second is the deferral entry, which is used to defer a revenue or expense that has been recorded, but which has not yet been earned or used. The final type is the estimate, which is used to estimate the amount of a reserve, such as the allowance for doubtful accounts or the inventory obsolescence reserve. Even though you’re paid now, you need to make sure the revenue is recorded in the month you perform the service and actually incur the prepaid expenses.

- For instance, if Laura provided services on January 31 to three clients, it’s likely that those clients will not be billed for those services until February.

- To get started, though, check out our guide to small business depreciation.

- Adjusting Entries also referred to adjusting journal entries which are made at the end of the accounting period to correct accounts before the financial statements are prepared.

- Because you know your inventory amount has decreased by $3,750, you will adjust your actual inventory number instead of posting to the reserve account.

- For example, let’s assume that in December you bill a client for $1000 worth of service.

The unearned revenue after the first month is therefore $11 and revenue reported in the income statement is $1. Accrued revenue is any revenue that your business has earned in a previous accounting time period but that you have not recognized until a later one. Adjusting entries need to be made at the end of each accounting period. As we have noted above, this can be done on a monthly, quarterly, or annual basis depending on the business entity in question. You do not want to be in a situation where you have “paid” for expenses before they have occurred or where you have “collected” unearned revenue before you can actually use it. This ensures you conform with the matching principle of accounting (whereby all expenses recorded are “matched” with the revenues that they help bring in).

With the Deskera platform, your entire double-entry bookkeeping (including adjusting entries) can be automated in just a few clicks. Every time a sales invoice is issued, the appropriate journal entry is automatically created by the system to the corresponding receivable or sales account. That’s why most companies use cloud accounting software to streamline their adjusting entries and other financial transactions. Want to learn more about recording transactions as debit and credit entries for your small business accounting? So, your income and expenses won’t match up, and you won’t be able to accurately track revenue. Your financial statements will be inaccurate—which is bad news, since you need financial statements to make informed business decisions and accurately file taxes.

Why are adjusting entries important for small business accounting?

The sum of the balances of the asset accounts ( less balances of any contra accounts) will be equal to the sum of the balances of the liability accounts plus the balance of the permanent owner’s equity accounts. During the accounting period, the office supplies are used up and as they are used they become an expense. When office supplies are bought and used, an adjusting entry is made to debit office supply expenses and credit prepaid office supplies. Prepaid expenses refer to assets that are paid for and that are gradually used up during the accounting period.

There’s an accounting principle you have to comply with known as the matching principle. The matching principle says that revenue is recognized when earned and expenses when they occur (not when they’re paid). At the end of each accounting period, businesses need to make adjusting entries. When you generate revenue in one accounting period, but don’t recognize it until a later period, you need to make an accrued revenue adjustment. If you have a bookkeeper, you don’t need to worry about making your own adjusting entries, or referring to them while preparing financial statements. If you’re still posting your adjusting entries into multiple journals, why not take a look at The Ascent’s accounting software reviews and start automating your accounting processes today.

Accounting 101: Adjusting Journal Entries

Accrued revenues are revenues that have been recognized (that is, services have been performed or goods have been delivered), but their cash payment have not yet been recorded or received. This is because, similarly to the above examples, the money that has been paid to you has not actually been “earned” yet — at least from an accounting standpoint. Failing to adjust your entries at the end of each accounting period will mean that your company’s financial statements are heavily unreliable and unpresentable. This can significantly bottleneck your business’s future growth by limiting the number of investment opportunities available.

Accrual accounting is based on the revenue recognition principle that seeks to recognize revenue in the period in which it was earned, rather than the period in which cash is received. For deferred revenue, the cash received is usually reported with an unearned revenue account. Unearned revenue is a liability created to record the goods or services owed to customers. When the goods or services are actually delivered at a later time, the revenue is recognized and the liability account can be removed. Adjusting entries for prepayments are necessary to account for cash that has been received prior to delivery of goods or completion of services.

Even though you are “adjusting” your business’s financial records, making an adjusting entry involves a proactive approach rather than a reactive one. This means that you will not need to go “back in time” to correct or alter any data. These are the assets that are paid for and which gradually get used up during the accounting period.

This is because, under the accrual basis of accounting, you need to register income/expenses as soon as invoices are raised or bills are received. The adjusting entry, therefore, shows that money has been officially transferred. In most cases, it’s not possible to remain in compliance with accounting standards – such as the International Financial Reporting Standards (IFRS) – without using adjusting entries.

If you do your own accounting and you use the cash basis system, you likely won’t need to make adjusting entries. To make an adjusting entry, you don’t literally go back and change a journal entry—there’s no eraser or delete key involved. In August, you record that money in accounts receivable—as income you’re expecting to receive. Then, in September, you record the money as cash deposited in your bank account. For instance, you decide to prepay your rent for the year, writing a check for $12,000 to your landlord that covers rent for the entire year.

Accounts That Need Adjusting Entries

Accrual accounting instead allows for a lag between payment and product (e.g., with purchases made on credit). Unpaid expenses are expenses which are incurred but no cash payment is made during the period. Such expenses are recorded by making an adjusting entry at the end of accounting period.

It’s similar to the example of pre-paid insurance premium we discussed above. Like the above examples, there are many situations in which expenses may have been incurred but not yet recorded in the journals. And also some of the income may also have been earned but not entered in the books. The other deferral in accounting is the deferred revenue, which is an adjusting entry that converts liabilities to revenue. Accrued expenses are expenses made but that the business hasn’t paid for yet, such as salaries or interest expense. If you haven’t decided whether to use cash or accrual basis as the timing of documentation for your small business accounting, our guide on the basis of accounting can help you decide.

Spotlighting CWRU students’ summer experiences for National … – The Daily Case Western Reserve University

Spotlighting CWRU students’ summer experiences for National ….

Posted: Thu, 27 Jul 2023 11:07:00 GMT [source]

Double-entry accounting stipulates that every transaction in your bookkeeping consists of a debit and a credit, which must be kept in balance for your books to be accurate. For example, when you enter a check in your accounting software, you likely complete a form on your computer screen that looks similar to a check. Behind the scenes, though, your software is debiting the expense account (or category) you use on the check and crediting your checking account. Deferrals refer to revenues and expenses that have been received or paid in advance, respectively, and have been recorded, but have not yet been earned or used.